WASHINGTON — Lockheed Martin has announced at the Air Force Association’s annual conference a new system of satellite buses that include both high-powered and nano-satellites. The announcement is part of the company’s mission to incorporate enhancements and common components intended to reduce costs and speed up production for space-based projects.

“We’ve invested $300 million in revamping our satellite solutions from top to bottom, applying what we learned from hundreds of small sat and geostationary missions. We now have one family for every mission fully integrated with our end-to-end capabilities in ground stations, payloads and software applications,” said Rick Ambrose, executive vice president of Lockheed Martin’s Space Systems unit.

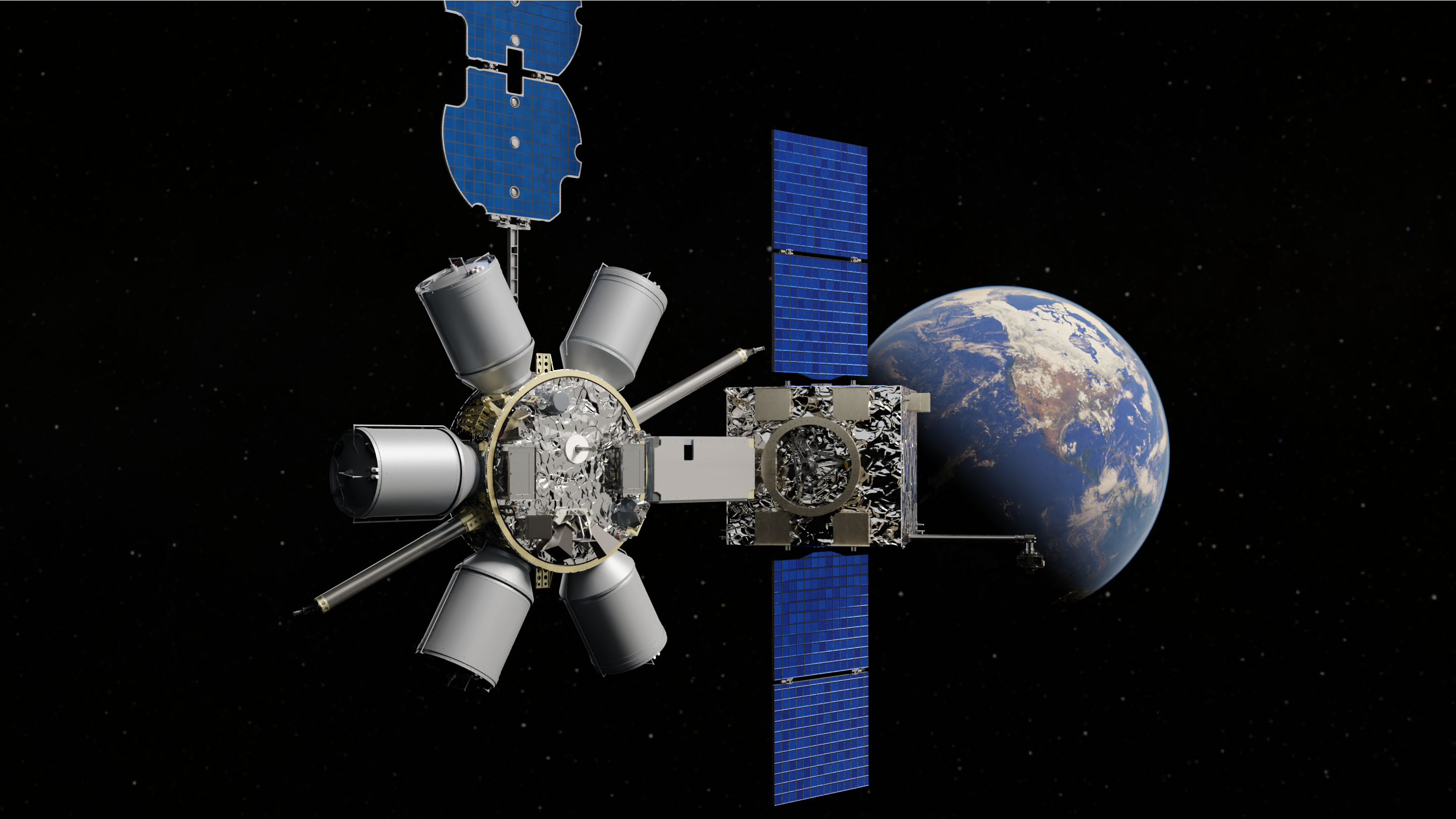

Lockheed’s new family of satellite buses includes the LM 400 Series, an upgraded version of the company’s small satellite bus with greater propulsion and the ability to fly in low-Earth orbit. The family also includes the LM 50 Series, a nano-satellite with a diverse range of power and size options.

Click here for the latest coverage from the Air Force Association’s annual conference!

All the announced satellites will share common components as part of a multiyear effort to reduce cost, increase component reliability and shorten design time.

“As technology evolves, customers have told us they want faster production cycles and more versatility for their dollar, and we’re listening” said Kay Sears, the vice president of strategy and business development within the Space System unit.

Lockheed had previously been awarded a $45.5 million contract for military code early-use software for GPS satellites, scheduled to be completed by December 2019. The Washington Post reported in August that Lockheed Martin plans to build a $350 million satellite production facility near Denver in order to “re-assert itself” in an increasingly competitive satellite development sector.

Lockheed’s new satellite bus program is the latest in a series of announcements from major technology firms and defense contractors to expand their forays into satellite technology. The Washington Post noted a $1.7 billion deal involving SoftBanks to combine Intelstate with OneWeb to create smaller, cheaper satellite models.

And Lockheed competitor Northop Grumman recently reached a deal to purchse Orbital ATK for more than $9.2 billion in an attempt to expand the company’s space and missile portfolio, with it’s sales expected to grow by $5 billion as a result.