Big data has proven to be more than a buzzword — it continues to be a big priority for agencies within the Department of Defense, creating opportunities for contractors who can add to intelligence gathering, analysis and cybersecurity.

As 2015 progresses, This year organizations like Defense Advanced Research Projects Agency (DARPA) are investing big money in research and development efforts related to big data. The result? Advanced analytics and technologies like distributed computing are fast becoming integral components of modern, networked weapons systems.

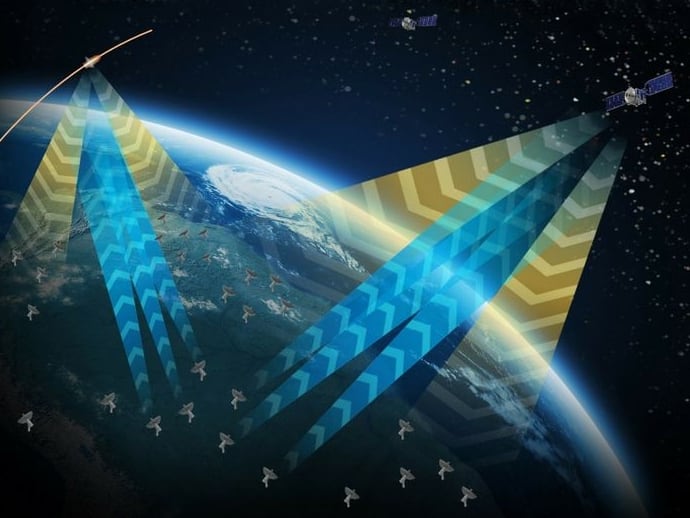

This shift reflects not only the growing complexity of weapons but also of the command and control capabilities employed by today's U.S. military. Faced with dwindling numbers of personnel, all branches of the DoD are turning to networked and unmanned weapons commanded and controlled from a distance to maintain American fighting power.

All of the military services are funding R&D efforts related to big data — and in aggregate that funding has grown annually (see above chart). The data reflects projects in the FY 2016 Defense Research, Development, Test, and Enhancement (RDT&E) budget request, which has yet to be approved, that are dedicated primarily to a form of big data R&D.

A number of new opportunities have appeared that are related to this trend.

Building the Cyber National Mission Force

U.S. Cyber Command and the General Services Administration recently issued a request for information seeking support for the Cyber National Mission Force. Related task orders will provide capabilities that range from all-source intelligence analysis to cyber operations, planning and training. The RFI requests analysis capabilities to fuse "reports from multiple intelligence sources (HUMINT, SIGINT, IMINT, MASINT) to provide intelligence preparation of the battlespace, target development, and early warning of emerging threats."

Harnessing data for the Joint Information Environment

The Defense Information Systems Agency (DISA) is soon expected to release a request for proposals for new Joint Management System (JMS) software that will include advanced analytics capabilities. The JMS is critical to the secure functioning of DoD's Joint Regional Security Stacks. Terry Halvorsen, the DoD CIO, stated recently concerning the JMS that the new commercial software should have the ability to "harvest security insights from data that is not intuitively security-related."

Advanced cloud analytics

DISA is also seeking big data analytics to add to its Cyber Security Advanced Analytics Cloud (CSAAC), which defends DoD networks where they connect to the Internet. There is an opportunity for contractors to provide software with advanced analytical capabilities that are: 1) open source, 2) commercial-off-the-shelf, and which 3) offer features that the current CSAAC solution does not already provide.

Cleared vendors should speak to the right people in the cybersecurity division at DISA or establish a mutually beneficial relationship with Northrop Grumman, the contractor that was awarded a $74 million task order in March 2015 for operation of the Acropolis big data storage portion of the CSAAC.

Analyzing insider threats

Defense officials recently announced the establishment of a Defense Insider Threat Management and Analysis Center (DITMAC) to identify and mitigate the security challenges posed by insider threats. Developed in the aftermath of the 2013 shooting at the Washington Navy Yard, the DITMAC will reach initial operating capability (IOC) in the fall of 2015. Its capabilities will utilize an array of predictive analytics that facilitate the identification of insider threats before they become a major hazard.

Looking Ahead

These opportunities are just the tip of the iceberg. Deltek forecasts that Defense spending on big data will rise steadily for the rest of the decade at a compound annual growth rate (CAGR) of 8.7%.

Across all sectors of government — civilian, defense and intelligence — the big data technology segments forecast to experience the highest growth are services (9.6% CAGR) and software (8.6% CAGR). Big data-related hardware will also grow, but at a slower pace (4.6% CAGR).

Lastly, the biggest drivers of growth in big data use at the DoD are expected to be cybersecurity and intelligence analysis requirements, as the department wrestles with a rapidly evolving array of threats to its operations and U.S. national security.

More information and analysis on Federal IT spending is available through Deltek's Comprehensive Federal Market Intelligence.

Alexander Rossino is a principal research analyst for Deltek, the leading global provider of enterprise software and information solutions for government contractors, professional services firms and other project- and people-based businesses.