The military space-industrial base is seeing strong growth as nations around the world recognize the importance of these military assets. Once a static industry dominated by a handful of contractors, it now has significant participation from emerging startups, which have received billions in private sector investments over the past decade.

Still, like the defense sector and the economy as a whole, challenges related to inflation, staffing needs and supply chain disruptions are impacting operations — with small companies and the supplier base affected more so than the large prime contractors.

It should come as no surprise the overall business of defense is booming around the globe, particularly in the United States and European NATO nations. Russia’s invasion of Ukraine in 2022 removed any doubts among politicians and military experts about the need for nations to maintain a strong defense. Worldwide spending topped $2.1 trillion for the first time in 2021, and it is forecast to surpass $2.4 trillion this year. (Concrete data is not yet available for 2022.)

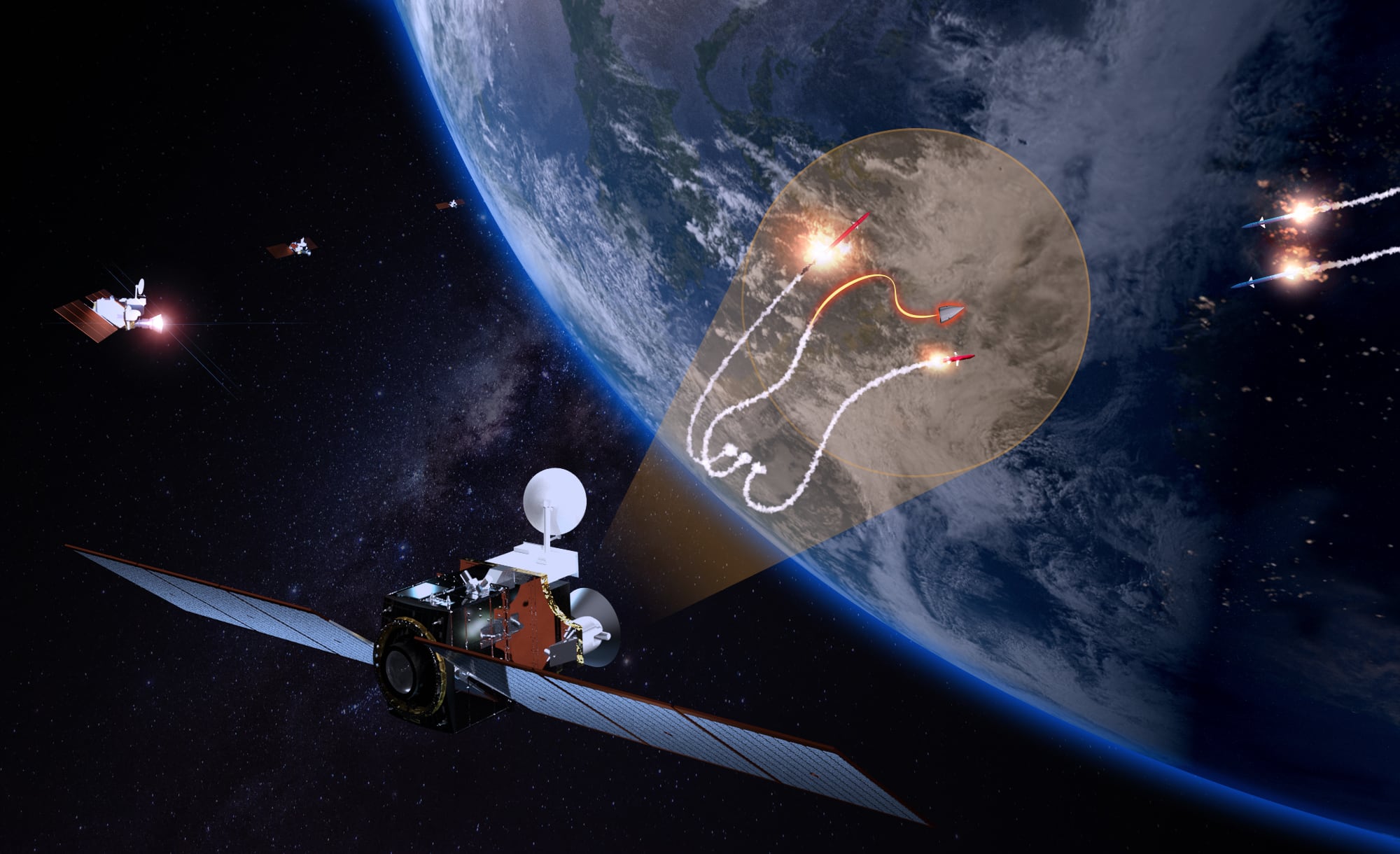

Despite analysts having compared this conflict to trench warfare seen in both world wars — due to the reliance on tanks and missiles versus maintaining air superiority — space has played a vital role. As a warfighting domain, space has seen its importance steadily increase since Desert Storm in 1990.

Today, it is absolutely critical to military planning, tactical solutions and operations, including monitoring the battlefield; identifying targets and assessing damage; providing data and communications from the platoon level to individual soldiers; controlling drones; monitoring weather; and providing navigation and positioning information. All of these activities have proved valuable to Ukrainian forces.

U.S. President Joe Biden’s $773 billion fiscal 2023 budget request for the Defense Department included $28.5 billion in military space funding — up from $17.7 billion in FY21 and $21.8 billion in FY22. And for fiscal 2024, SPADE Indexes anticipates a rise by several billion dollars more.

Over the past few years, Congress has showed a strong commitment to boosting the budgets of the Space Force and the Space Development Agency by funding new efforts related to early warning satellites to detect and track ballistic and hypersonic missiles as well as expand global positioning, navigation and communications capabilities.

Despite this robust pipeline of activity, the military space-industrial base is facing a number of economic and industrial challenges. These include:

Inflation: In 2022, the United States and other nations saw a surge of inflation that impacted consumer and industrial pricing. When it comes to space infrastructure, there is a dichotomy between what the large prime contractors are saying and what small firms and suppliers are reporting. At a recent Cowen investor conference, large primes like Lockheed Martin and Raytheon Technologies called labor and supply chain inflation manageable. And they said cost-plus contracts allow them to pass increases to their customer and that fixed-price contracts can be offset by productivity gains, cost-cutting efforts and negotiations with suppliers.

Smaller firms and subcontractors, however, report they are negatively impacted by rising costs that are sometimes double or triple their originally forecasts due to the increasing rate of inflation, leaving them little room to maneuver. Squeezed by inflation, their issue is how to retain existing employees with the cash they have, not necessarily how to ramp up to meet demand.

Supply chain disruptions: Prime contractor executives collectively stated that after a smooth fourth quarter in FY22, the first quarter of FY23 is seeing some pressure. But they were confident this would be less bumpy as the year progresses. Manufacturers are working to qualify additional suppliers on key programs and secure additional sources for critical commodities and components.

One area of concern remains microelectronics, for which defense firms have been negotiating to get a priority place in line. A reliance on microchips produced in Taiwan — a potential military hot spot — remains a key issue. Any impact from the $280 billion investment from the CHIPS and Science Act passed in August 2022 to boost U.S. domestic semiconductor capability is likely years from being realized.

Staffing: Labor inflation, especially for those with critical skills or security clearances, had firms offering midyear raises to attract or retain employees. Recent layoffs in Silicon Valley and related tech firms could direct commercial software developers and systems engineers to defense sector opportunities.

Structural transformation: The military space-industrial base is undergoing a revolution unlike anything it has experienced since the first defense satellites were developed in the 1950s. An influx of private capital into commercial space companies has been transforming and expanding the space-industrial base for the past several years. Whereas two or three contractors might have had a skill set to meet military and defense community needs in the past, today dozens of new entrants are competing for contracts.

As the U.S. military increasingly shifts to becoming more reliant on commercial providers, it must consider how to identify which, of the hundreds of firms operating today, will still exist to support efforts in future years.

To provide greater stability so private firms can forecast future demand, the DoD is pursuing new approaches to acquisition, including large block buys and multiyear procurements, as well as the recent 10-year deals with three commercial satellite firms providing imaging data. Early adopter deals for products and services to build a local hardware supplier base are also being addressed.

Additionally, the military space community has been working to strengthen private-public partnerships and shift from customized hardware and niche components to those commercially available. Doing so ensures the government doesn’t have to bear the entire cost of development for unique designs, while increasing its agility and access to hardware.

Despite these challenges, the military space-industrial base around the world remains healthy, thanks in large part to an increasing reliance on space systems. There is strong demand in the U.S. for new satellites to meet important missions and a number of substantial classified programs that can drive growth in the coming years.

For investors, publicly traded space firms with defense exposure have seen less volatility than other startups. And whereas space-focused, exchange-traded funds have gained limited traction with investors, the benchmark SPADE Defense Index reached all-time highs in February 2023 and saw inflows of tracked capital triple in the last year to nearly $2 billion.

Scott Sacknoff is the president of SPADE Indexes and manages the SPADE Defense Index.