BAE Systems, Inc., the U.S. subsidiary of BAE Systems plc in the U.K., is a defense giant in its own right — operating relatively independently as is required by U.S. procurement standards, but still competing handily with the largest companies supporting the military services around the globe.

If you ask CEO Jerry DeMuro, he’ll say the main accomplishment thus far in his four years since coming on board from General Dynamics is further unifying a business primarily born out of acquisition. He sat down with Defense News to discuss the business today.

What would you categorize as your three most critical military efforts right now?

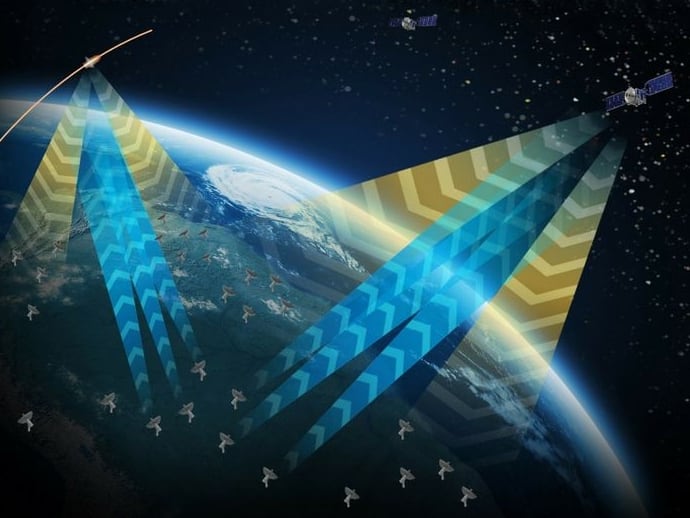

I would put electronic combat solutions, which is not just [electronic warfare]. It’s got some offense and defense on cyber. It’s got some countermeasures, whether they be electronic or infrared countermeasures protective systems. That whole class is just exploding and very high priority for our customers if you think about what the Air Force, particularly with its platforms, is trying to accomplish.

Before you move on to the next, let me interrupt you. In terms of EW, all we are hearing is how far behind the U.S. is, how we took our eye off the ball, and how Russia is advancing. What are your thoughts on that and what can industry do to push this forward?

I think both the customer and industry are collaborating very well in what I would call sixth-generation capabilities, as well as being able to deploy the current capabilities in a very small form factor so they could be used in manned, unmanned, small platforms. Think of an application like the long-range anti-ship missile, the LRASM. We essentially put some of those capabilities, very small form factor, in the front end of a weapon. So some of the technologies are being applied very quickly to address those perceived gaps, at the same time we’re working on the next generation of capabilities.

[Those capabilities involve] not only looking at emerging and advanced threats, multispectral threats, and being able to counter those, but also cognitive electronic combat. So you use machine-learning algorithms to characterize the threat in real time. Then, to develop and address that threat in real time as you look at the model today, it is understanding what that total threat profile is, developing the counters, loading it into the systems, and then off you go. This is about doing it in real time and being able to do it autonomously.

Do you feel the proper procurements are in place to actually get there?

I think the right kind of development efforts and focused efforts are going on. There is quite a bit of dialogue.

Okay. So, other priority programs?

A very important and critical focus for us is in the land domain and particularly combat vehicles as both [the] U.S. Army and the Marine Corps recapitalize the combat vehicles fleets. There is a whole host of programs, which collectively begin to provide [the military] with capabilities that they say they need for the next couple of decades. [With the Armored Multi-Purpose Vehicle] program, I think the Army has taken a brief pause to think about a long service duration that these will have and building in the additional capacity for the growth in that long service period. At the same time, they are modernizing the balance of the Army brigade combat team vehicles. As you know, we have four of them. We are proceeding with a major upgrade to the self-propellant howitzer, the M109. The Bradleys are receiving some very significant upgrades in both mobility, command and control, and survivability. We are also looking at enhancements to the M88 [vehicle]; as these vehicles get larger, heavier, more complex, how do you service them in the field? So that whole category of programs, along with the amphibian programs that the Marine Corps is looking at.

It’s not just building those vehicles. It’s also looking at next generation, generation and a half. How do we enhance lethality and survivability? So when I get to lethality, it is about also a set of programs related to precision-guided weapons. We have a whole class of things going on all the way from the [Advanced Precision Kill Weapon] System where we have gone from virtually zero to — I think this year we are going to do 10,000 units. It’s a very popular weapon to be used on everything from the A-10 and the F-16 to rotary-wing aircraft, domestically and internationally. We have like 20 or 21 letters of request in on it.

Can you talk me through BAE’s strategy for the Mobile Protected Firepower program? What are you hearing from the Army?

I think the Army is looking at its mission in Europe, in particular in the near term, as well as its recent experience in the Middle East, and [the need to be] able to project power very rapidly to that level of lethality. It’s very difficult to move an Abrams [tank] in any quantity. I think this chief and his team would like to accelerate that. We see it very high on their priority list, as you know. BAE actually won the program back in the mid-90s to do essentially this.

So if the Army is serious, and they certainly appear to be in our meetings with all levels [of leadership] including [Chief of Staff for the U.S. Army] Gen. [Mark] Milley, we intend to pursue it very vigorously. We think we have a great solution that will optimize mobility, lethality and survivability, and answer the needs of the Army. We are fully prepared for the very low-risk, high-performing solution, and we applaud the Army’s initiatives in acquisition strategy, maybe taking some lessons from successful programs like [the Amphibious Combat Vehicle] to really reduce risk.

I know BAE has a role in the LCS program. What do you think about the Navy’s decision to pursue a new frigate design?

We are not a shipbuilder. Our core capability is in modernization. That’s where our expertise lies. Could we bring some of the skill sets and capital assets that we have to bear? If we had the right partner to design and build those ships. Design and new construction is not our forte.

Are there any other opportunities? I know the U.K. business is interested in actually pitching for the new frigate.

The Type 26 that they are designing and building for the U.K. I think is a fantastic ship. It is the most modern, purpose-design-built ship that I am aware of for the anti-submarine warfare mission, for instance. We might serve as a channel to market, or they might partner with a build yard. So that is wide open.

Presumably you could have a role in the ammunition systems?

Oh absolutely. The Mark 45 gun is the gun of choice. I think you will see some of the enhancements that we are putting into that generation of the Mark 45 gun work its way back into various navies including the U.S. Navy.

The U.K. business announced some cuts recently at least partly related to Typhoons. Is there any trickle down at all for the business here?

Not really. The way I would characterize the changes is that it’s just simply positioning a business for the coming market conditions. It’s not a mystery. We have been out there talking about Typhoon production ramping down at a slower rate. It’s going to continue through the early ’20s with the book of business that we have today. But I think you add some customers like Saudi Arabia — they are going to want more indigenous capability. Most people don’t realize that the support revenue in air domain, supporting things like the Tornadoes that are out there and Typhoons, is now equal to the production revenue. So it’s simply positioning for future market circumstance.

There is also a streamlining of the organization, and the overhead and the structures there, because the customers are primarily international rather than just domestic. So bringing that together and having them report directly into the new CEO, both maritime and air, will give [leadership] more insight and direct connectivity into the business. [That is] pretty consistent with his three stated priorities when he came on board – operational, performance, and excellence. He wants to see it, touch it.

What is your initial take on President Donald Trump’s approach to the defense industry, to defense investment?

First, I would say we continue to be very encouraged by his and his administration’s consistent support of a need for greater investment in the defense segment. Services have a number of gaps. I think he has taken the time to personally get involved and understand what some of those gaps are. He has reestablished the relationship with the service chiefs, leads, with [Secretary of Defense] Gen. [Jim] Mattis [(ret.)]. So I think he has an appreciation; when he speaks about the need, it is genuine. The budget submitted by the administration is demonstration of his continuing support for that. Also, when he takes time to learn about an issue like F-35, he is not afraid to move in and serve as a catalyst to break some log jams and get some things moving.

Did he take the time to learn enough about it before he spoke?

You know, that’s not for me to comment on. I didn’t have the detailed discussion. What I can tell you is that I think his interest was sincere. I think both parties would agree, as [Lockheed Martin’s] Marilyn [Hewson] has said, as [BAE’s Ian] King said before he retired, that he did serve as a catalyst to move the ball forward. Sometimes parties can get a bit positional. I think that was a way to get the process kick-started and moved forward. He is proactive.

Do you approach his administration the same as you do any other?

This message of having a dialogue with industry is important to understand the art of the possible, to understand what the differences are, the barriers to getting to agreement like the F-35. We see that reflected through Secretary Mattis. As you know, all of industry has had a meeting with him. [Under Secretary of Defense for Acquisition, Technology and Logistics] Ellen Lord is setting up her own meetings. I don’t think it’s an accident either that people like [Deputy Secretary of Defense] Pat Shanahan and Ellen Lord, who have private industry experience, are in the administration. I think that’s a positive to try to bridge the gap that sometimes forms.

Much like yourself and your industry, you are trying to communicate with people that want to consume [information] in a digital form. That’s his style, trying to deal more directly than perhaps through the press or intermediaries to get his message out there. That’s fine. That’s his chosen method. It’s up to us to understand it.

What is the benefit of having industry representation in the Pentagon, and is there a downside — particularly when you consider Capitol Hill has voiced skepticism?

It’s a bit bemusing to me that we can entrust these people with the greatest national secrets and security, [but] we are worried then about their business integrity going forward, when there are so many systems of checks and balances around them. This administration is attempting not necessarily to get, specifically, defense experience in there, but private industry experience — how you look at business decisions rather than looking at everything on a straight transactional basis, contract by contract, audit by audit. We both exist in the same ecosystem.

For instance, in the path that we have been on with intellectual property rights. I can understand why DoD wants the intellectual property rights, but at the same time when you look at contract by contract to try to get those intellectual property rights, it may have a chilling effect on investment and innovation, which is what they also want with declining budgets and R&D and ‘bring me prototypes rather than long development contracts.’ I think having an industry perspective makes sense.

Of course the plan now at the Defense Department is to split procurement from R&D. Could that separation increase the risk that we don’t get innovation integrated into procurement?

[Leadership among industry] had this specific issue on the agenda to discuss with Ellen. There is a school of thought that says this could make it difficult to transition — where does one leave off and one pick up, where is the milestone authority as you go through this process? Maybe as important as anything in Washington, where does the money and the budget authority reside?

I think these are all challenges that we have to work our way through, but I think the intent to accelerate development of technologies and get them to the troops or fighters sooner is appropriate. There are some administrative and mechanical things that remain to be seen. But there could be a challenge there. You just have got to work through the road map.

We are hearing a lot about America First; is there any chilling effect on the international community?

There is a little bit of concern internationally as to whether or not the United States is going to be a reliable partner; if they are going to invest in a major platform or product that goes in a platform, that’s got a long life. I think those nations want to be sure that they have a reliable, dependable partner and a source of supply. But beyond that, I think they understand. They all are looking at the issue of employment in their own nations. Manufacturing jobs is something that is very important to this administration. So I think they recognize that there is a balance there.

It seems like there is an interesting shift in terms of demand, understandable demand, around the globe where they expect more investment in return.

This administration understands that these other nations would have the same concerns about meaningful employment and sovereign capability through the entire life cycle of the product. I don’t see any chilling effect on this side either about working with those countries on industrialization, in digitization, offset programs. Both parties understand each other very well. I think that this administration is, in fact, saying: “Why not buy American when it’s out there?”

Gen. Mattis has talked about the importance of interoperability and working in coalitions, and one of the best ways to make that happen is through either direct or foreign military sales. It also clearly benefits the Department of Defense because it gives you economy of scale. It maintains an industrial base.

How are U.S.-based companies investing globally?

We partnered with a European company, IVECO, [for the Amphibious Combat Vehicle program], a great partner, to accelerate and reduce the risk to the Marine Corps. F-35 is a multinational collaboration not only in the delivery of the initial product, but in the long-term support model.

We also have within the Inc. portfolio several European operations. It’s certainly more common that those European partners work together to develop and enhance the capabilities, for instance on our infantry fighting vehicle, the CV90. One nation is developing a variant as active protection systems, which will then move back through the install base. Another country is working on the next set of command and control variance. A third country is also working on putting a mortar system in it. So we see that collaboration quite a bit in Europe.

Jill Aitoro is editor of Defense News. She is also executive editor of Sightline Media's Business-to-Government group, including Defense News, C4ISRNET, Federal Times and Fifth Domain. She brings over 15 years’ experience in editing and reporting on defense and federal programs, policy, procurement, and technology.