SINGAPORE — The Air Force intends to cancel the JSTARS recap program in its fiscal year 2019 budget submission, tanking one of the service’s few remaining aircraft production opportunities still in contention.

The Air Force had planned to buy 17 new JSTARS recap planes to replace its legacy inventory of E-8C Joint Surveillance Target Attack Radar System battlefield management and control aircraft, with Boeing, Lockheed Martin and Northrop Grumman — the three major U.S. military aircraft manufacturers — all vying for the prime contractor slot.

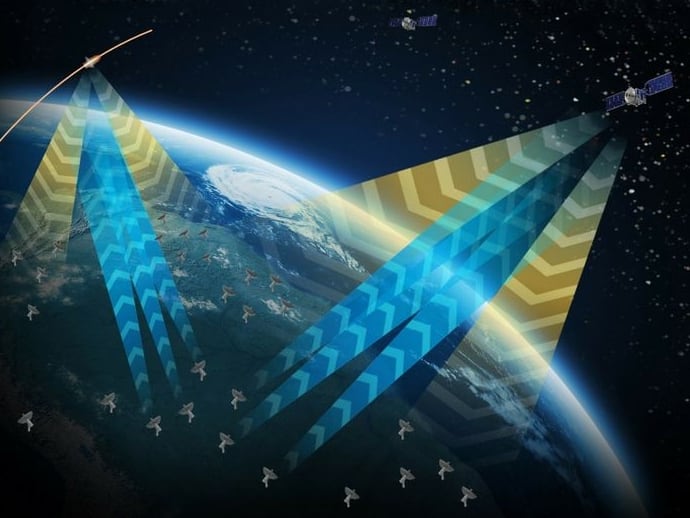

Instead, it will push forward with a system-of-systems approach that will link together existing platforms to track ground targets and do command and control, sources with knowledge of the budget told Defense News.

The Air Force’s decision to terminate the recap program will come as little surprise to those closely watching the competition. News of the potential cancelation broke in September, when a handful of lawmakers released a letter to Defense Secretary Jim Mattis that condemned the Air Force’s plans to explore alternate options for the airborne command and control mission.

In recent months, the service seemingly doubled down on the system-of-systems approach, with top officials from the Air Force’s top civilian to the head of Air Combat Command all questioning — in public — whether a JSTARS recap made sense given future threats.

Air Force Secretary Heather Wilson repeatedly argued that a more distributed solution could be used to meet demands. The legacy JSTARS fleet currently meets only 5 percent of the requirements of combatant commanders, she said, and by the time the recap system would be fielded, it would meet “less than one percent” of those needs, she said in November.

Gen. Mike Holmes, the four-star in charge of Air Combat Command, noted similar concerns during the Air Force Association’s annual conference this September.

“The question really is, how long do we continue to fund the GMTI [ground moving target indicator] capability in the classic way we’ve done it: with an integrated platform that has a sensor and air battle managers onboard,” that then communicate in the line of sight with people to take on tasks, he said.

“How much of our threat environment in the future will allow us to do that?”

Industry setback

The decision comes as a major blow to Lockheed, Northrop and Boeing, all of which hoped to win the estimated $6.9 billion contract for engineering, manufacturing and design of the plane. Each of the companies have invested millions of dollars of their own funds to hone their designs and were awaiting source selection by the government.

Proponents of the program on Capitol Hill have already noted that taxpayers have invested more than $265 million thus far in early research funding. About $400 million in additional funding has also been approved in the 2018 national defense authorization act, but congressional appropriators — who actually hold the purse strings — have not yet settled on how much to allocate.

Lawmakers have already put some limits on whether the Air Force will be allowed to go through with their plan to cancel the program. The 2018 NDAA stipulates that, should the service at any time terminate the program, Defense Secretary Jim Mattis must submit a report at the time of the budget request laying out why it was canceled and how the service will continue to meet the mission. He must also certify that a capability gap will not be caused by the decision.

Now, the T-X training jet and UH-1N Huey helicopter replacement program — both also in source selection — stand alone as the service’s major aircraft modernization opportunities. Boeing and Lockheed are competing in both contests.

Of the three primes, Northrop, the prime contractor on the legacy E-8C JSTARS, is the most hurt by the program’s cancellation.

The company dropped out of the T-X competition last year and does not manufacture helicopters. It also had won a battle against Raytheon to produce the radar for the JSTARS recap program, which would have given it a win even if it had not nabbed the EMD contract.

Boeing also had high hopes for its JSTARS recap bid, envisioning its 737-based offering as the start of a line of 737-derived special mission aircraft that could eventually replace planes like the E-3 AWACS or RC-135 Rivet Joint.

During an interview at the Singapore Airshow on Tuesday, Orlando Carvalho, the head of Lockheed’s aeronautics division, said that source selection activities were continuing and that competitors had not been briefed on the fate of the program. However, he indicated that Lockheed would not fight the cancellation of the program, if that was what was decided.

“If ultimately the Air Force decides to not go forward with that program, clearly we will respect that decision. And frankly, we understand,” he said during an interview Tuesday at the Singapore Airshow. “Having insight into some of the operations that have been going on in the Middle East, things like that, we can appreciate the tradeoff that the Air Force is trying to make.”

Valerie Insinna is Defense News' air warfare reporter. She previously worked the Navy/congressional beats for Defense Daily, which followed almost three years as a staff writer for National Defense Magazine. Prior to that, she worked as an editorial assistant for the Tokyo Shimbun’s Washington bureau.