COLORADO SPRINGS, Colo. — On May 4, SpaceX launched its latest batch of Starlink satellites, increasing the size of its behemoth broadband internet constellation to more than 4,000 spacecraft.

The company, owned by billionaire Elon Musk, expects to launch another 8,000 Starlink spacecraft in the next three years — and it’s not the only satellite manufacturer eyeing large fleets of small space vehicles in low Earth orbit, roughly 1,200 miles above the planet’s surface.

Other companies with ambitions in LEO include Jeff Bezos’ Amazon, which expects its Project Kuiper constellation to feature more than 1,500 communication satellites by 2026, and OneWeb, a London-based firm that has already launched more than 600 spacecraft to its satellite internet constellation as of late March.

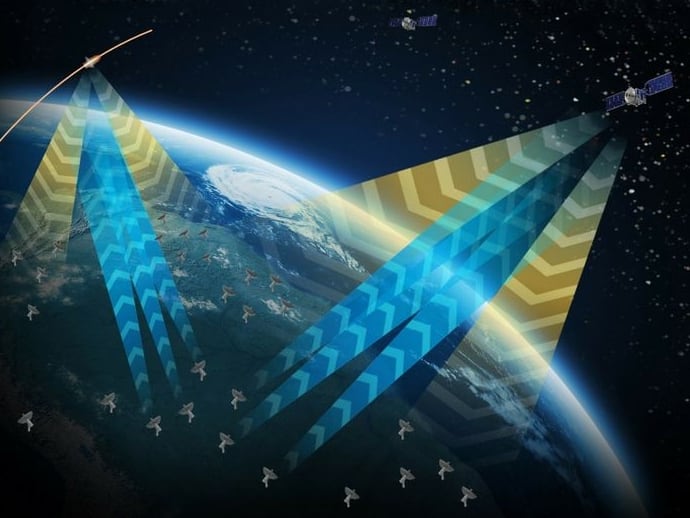

On the government side, the U.S. Space Force’s Space Development Agency expects its Proliferated Warfighter Space Architecture will include hundreds of spacecraft providing low-latency communication and missile tracking capabilities. Space Systems Command, the service’s primary acquisition arm, is considering how it might adopt this model for other mission areas.

The rise of proliferated satellite constellations creates a need for more rockets, and in the last few years, a number of new entrants have ventured into the launch scene — including Firefly Aerospace, Relativity Space and ABL Space Systems — and more established companies like SpaceX, United Launch Alliance, Blue Origin and Northrop Grumman have revealed plans to upgrade or build new launch vehicles.

Underpinning the swell of commercial and military activity in orbit and the demand for rockets to support it is a launch range infrastructure that is largely managed by the Space Force.

The service operates the two busiest spaceports in the U.S. — the Eastern Range at Cape Canaveral Space Force Station in Florida and the Western Range at Vandenberg Space Force Base in California. The complexes, which just a decade ago were flying only a handful of missions each year, provided payload processing and support for 73 missions in 2022.

The service expects to surpass 130 launches this year — a number officials say could triple in the near future.

Randy Kendall, vice president of launch and architecture operations at Aerospace Corp. — a space-focused federally funded research and development center based in El Segundo, California — said the alignment between government and commercial requirements, the capital from billionaires like Musk and Bezos and technological advances that are driving down the cost to orbit likely means that launch demand continue into the foreseeable future.

And with that sustained demand, he said, comes increased strain on the Space Force’s launch infrastructure.

“As that total pace of launch grows, obviously the major theme is congestion,” Kendall told C4ISRNET in an interview. “Congestion on the schedule, getting a range date, congestion in the airspace traffic on and around the spaceport. . . . It’s really putting a strain on the infrastructure.”

Spaceport of the future

The Space Force’s launch enterprise has been anticipating this kind of growth, and the resulting congestion, for several years. In 2017, when the service was still part of the Air Force, it launched a campaign called “Drive to 48″ that set a goal of preparing its ranges to support 48 launches a year by the early 2020s. It hit that target for the first time last year with 57 missions.

In 2018, then-commander of Air Force Space Command Gen. Jay Raymond convened a task force to study what a “Range of the Future” might look like for the service. That work turned into a strategy targeting the architecture, infrastructure, policy, operations and business model shifts required to contend with commercial launch demand.

Since then, the service has made progress to reduce the strain on its ranges and ensure it can adjust to that growth — streamlining its launch processes, crafting roadmaps for infrastructure improvements and implementing automated safety requirements for launch providers that reduce the amount of personnel and ground-based radars required at its ranges.

Col. Mark Shoemaker, vice commander for operations at Space Launch Delta 45 at Cape Canaveral, said the efforts have changed the way the service views its launch enterprise; no longer just a collection of instrumentation and telemetry, the Space Force wants to run its ranges more like airports (or spaceports) that provide a service to its customers.

“We spent a lot of time and effort, not on buying new equipment but looking at just the way we make decisions and the ‘why’ behind the policies that we had in place,” Shoemaker told C4ISRNET in an interview. “Really what it did was change the mental model and get us ready for the increase in launch.”

Legislative hurdles

Col. James Horne, deputy director of Space Systems Command’s Assured Access to Space Directorate, told C4ISRNET the idea is for these spaceports to create “an environment where we have unlimited ability to support whatever the commercial launch industry brings to us.” Under a spaceport model, the Space Force units, or deltas, that manage launch ranges would function as airport authorities, providing a suite of services that companies can draw from based on their needs.

The service is still trying to close the gap between perceiving its ranges as spaceports and actually operating them that way, and is looking to the fiscal 2024 legislative cycle as a chance to address some of the policy and funding challenges that are impeding that shift, Horne said.

The service’s fiscal 2024 budget includes $1.3 billion over the next five years for infrastructure projects at the Cape and Vandenberg meant to increase the number of launches they can conduct. It also asked Congress — as part of a batch of legislative proposals the White House sent to lawmakers in mid-April — to consider changes to the law that would allow it to operate its ranges more like a port authority.

Under the Commercial Space Launch Act, signed in 1984, the service can charge companies for marginal costs like electricity at a launch pad, but it can’t impose fees for overhead infrastructure. The law also restricts the Space Force from accepting in-kind contributions from commercial companies to upgrade its ranges, a practice that is standard at port authorities.

These policy issues, according to Aerospace Corps’ Kendall, are the biggest constraints on the service’s ability to create more capacity at its ranges.

“If that policy would change, that’d be a huge enabler to be able to get to higher commercial launch rates,” he said.

Making space for more companies

As the Space Force awaits these policy changes and new funding streams, it’s working with companies to expand its launch cadence within the existing parameters and reduce any paint points that contribute to backlog or scheduling issues.

At Cape Canaveral, the busier of the Space Force’s two launch hubs, the range team is partnering with NASA’s neighboring Kennedy Space Center to find space for more companies to secure launch facilities.

Shoemaker said the service has “good cooperation” with the agency, but is running out of land and options to grow its footprint. The number of pads the range could add depends on a number of factors, including the size of a company’s rocket, but he said it’s likely in the “low single digits.”

The Vandenberg complex, which sits on 100,000 acres of land along California’s central coast, faces a different challenge. Col. Robert Long, who oversees the range as commander of Space Launch Delta 30, told C4ISRNET that while the base has plenty of land, there are environmental constraints that make expansion difficult.

“Much of that is undisturbed ground. So if you’re going to build infrastructure, there are certain policies and processes that are in place,” he said.

Vandenberg also serves as a major test range for Defense Department missile programs, including the Air Force’s new Sentinel intercontinental ballistic missile, which could fly for the first time this year. Long said balancing the needs of the testing community while also meeting demand for more launch is a challenge.

Both ranges are also looking to reduce congestion in the launch process, particularly in the area of payload processing. Before a satellite is ready to lift off, all of the hardware and equipment that it’s carrying must be prepared and validated. The increase in launch rates means more satellites need to be processed — especially for missions carrying multiple spacecraft and payloads — and when there’s not enough capacity to do that, it creates a backlog.

“It’s become one of our true bottlenecks going forward that we’re really focused on trying to throw as many tools at as we can to help remedy,” Horne said.

The service has identified space at both ranges where they can host more processing facilities and are working with companies to determine whether there’s interest in performing that work. Cape Canaveral is in discussions with several companies and Vandenberg is in the initial outreach stage.

Expanding spaceport access

Horne said that from an enterprise perspective, the service is looking at options to expand the number of federal spaceports that companies can access. Today, the U.S. hosts 20 spaceports, six of which are federally run. Only four of those installations, including Vandenberg and Cape Canaveral, can support vertical launch, which is the predominant need.

The Space Force isn’t likely to be operating more ports in the near future – Horne said the service is focused on its existing ranges “for now” — but instead is deepening its partnerships with the other ranges.

“We are reaching out to them . . . cross-talking, sharing common challenges,” he said. “And if we have had a challenge that we have overcome, [we’re] sharing that with those spaceports.”

To further help strengthen those partnerships and better understand the challenges that come with greater commercial launch demand, the Federal Aviation Administration formed a National Spaceport Interagency Working Group.

The group — which includes representatives from the Space Force, the Federal Aviation Administration, NASA and the departments of Commerce and State — is crafting a national strategy that aims to make U.S. spaceports more resilient and standardized. Horne said the panel has completed a rough draft of the report and expects a final version by the end of this year or early next.

“We see a need to probably expand the number of spaceports and access points we have, and so the strategy is about the national means to enable that to happen at scale and quickly and to ensure interoperability and the right policy mechanisms to encourage the growth of spaceports nationwide,” he said. “We know that it’s important for industry. It’s also important for resiliency from a national security perspective.”

Courtney Albon is C4ISRNET’s space and emerging technology reporter. She has covered the U.S. military since 2012, with a focus on the Air Force and Space Force. She has reported on some of the Defense Department’s most significant acquisition, budget and policy challenges.