The Federal Communications Commission announced Nov. 18 it plans to hold a public auction for C-band spectrum, freeing up much of the needed space for 5G usage.

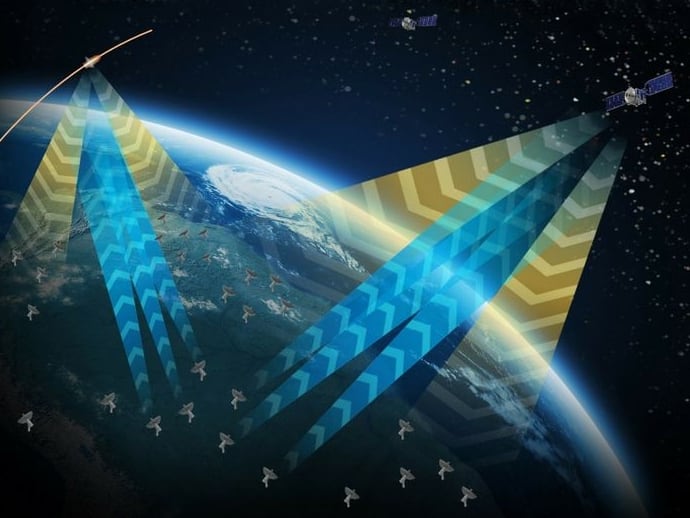

Commercial satellite companies use the C-Band spectrum primarily for satellite communications — with the military serving as a major customer — or satellite television, but many telecommunications companies have eyed that same spectrum as the perfect space for 5G.

FCC Chairman Ajit Pai’s decision to sell off the spectrum via a public auction was seen as a negative for the four satellite operators that hold that spectrum — Intelsat, SES, Eutelsat and Telesat. Those companies had hoped to auction off the spectrum themselves and make a return on their investment in the space. Intelsat, the biggest of the four, saw their stocks drop by 40 percent Monday following the announcement.

Pai justified the decision, stating that the FCC needs to free up significant spectrum for 5G quickly while generating revenue for the government and ensuring continued C-band services.

“After much deliberation and a thorough review of the extensive record, I have concluded that the best way to advance these principles is through an auction of 280 megahertz of the C-band conducted by the Federal Communications Commission’s excellent staff,” Pai said in a letter to lawmakers Nov. 20. “With a quarter-century track record of transparent and successful auctions, I am confident that they will conduct a public auction that will afford all parties a fair opportunity to compete for this 5G spectrum, while preserving the availability of the upper 200 megahertz of this band for the continued delivery of programming.”

RELATED

Legislation authorizing such an auction was quickly introduced by Sens. Roger Wicker, R-Miss., and John Thune, R-S.D., following Pai’s announcement.

“After years of delay, this legislation would get crucial mid-band spectrum into the market to benefit the American people and secure our position as the leader in the race to 5G,” said Wicker in a statement. “Senator Thune and I have been working together for over a year to come up with the best way to expand access to 5G, especially in rural areas, and secure value for all Americans.”

If passed, the bill would require the public auction to start no later than Dec. 31, 2020.

The auction does represent a security tradeoff, said Daniel Bennett, a senior technical advisor at the National Renewable Energy Laboratory’s Energy Security and Resilience Center. While some have been eyeing C-Band, which has a frequency range between 4-8 GHz, as a prime location for 5G technology, the Department of Defense is currently a major user of that spectrum for military satellite communications.

“We see the rest of industry kind of pushing towards sub-6 [GHz for 5G usage], so the benefit in that regard is having more sub-6 band to be able to leverage,” said Bennett at the CyCon U.S. conference Nov. 19. “But at the same time we’re taking it away from DoD entities.”

Still, leaving that spectrum with the Department of Defense could leave the United States behind when it comes to the development of 5G technology, said Jim Lewis, senior vice president of the Center for Strategic and International Studies.

RELATED

“The Defensive Innovation Board put out a report on 5G that the U.S. was at a disadvantage because it didn’t have the right spectrum for some 5G applications and we would have to move [it over to 5G use],” said Lewis. “Finding ways to free more spectrum for 5G will be one of the big debates over the next few years.”

Military equipment that was built to operate on the spectrum that is being moved to the commercial sector will have to be upgraded, retrofitted or otherwise adapted to use a new spectrum. In the past, some of those costs have been offset with revenue from the public auction of the spectrum, said Lewis.

While the FCC’s move was driven by a need for 5G spectrum, it follows an ongoing movement to shift spectrum from the military to the commercial spectrum.

“A lot of the story of the spectrum in the U.S. ― really for the last 15 years ― has been moving spectrum away from DoD and towards commercial,” said Lewis. “With the advent of the mobile phone, spectrum that was once DoD’s or NASA’s or other government agencies’ that no one cared about, now there’s a demand for it.”

Nathan Strout covers space, unmanned and intelligence systems for C4ISRNET.